Over 12 million Americans take out a payday loan every year, paying a staggering $9 billion in fees.

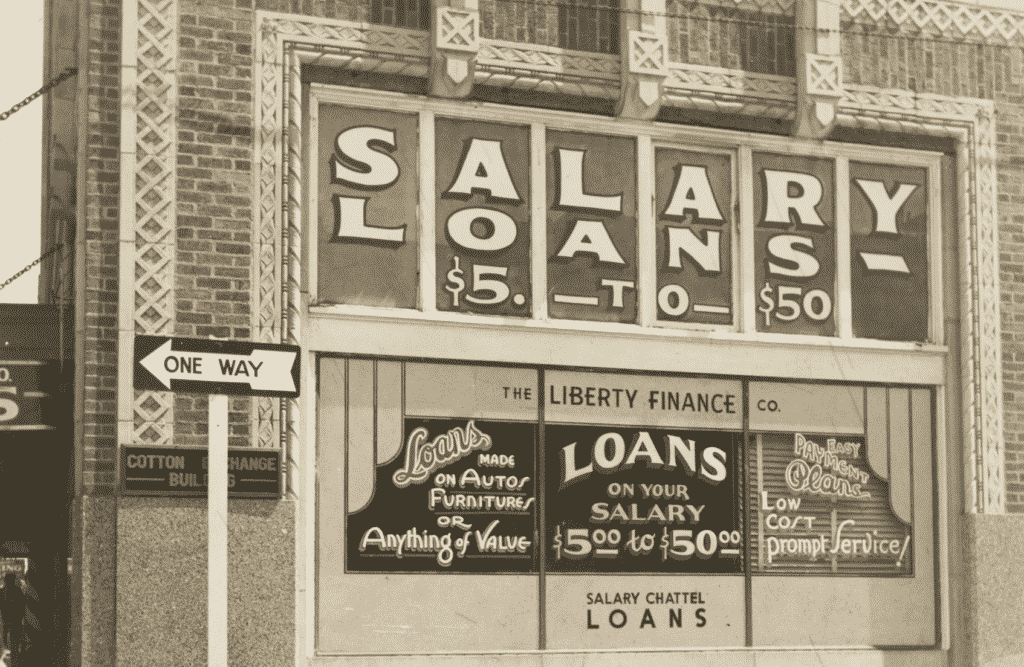

What is a payday loan? It is a small amount of money loaned to someone with the agreement that the loan will be paid back with interest upon the person’s next payday. Often referred to as “cash advances,” a payday loan has the average loan term of two weeks. These loans help people with low or no credit who need cash immediately. Below I’ll discuss the positive and negative effects of payday loans.

Pros of Pay Day Loans

1. Easy to Get

A payday loan is extremely easy to get approved for. Meaning just about any person in the world could theoretically apply and get approved for one. They don’t check a person’s credit history or income, and all it takes is a simple application.

2. Good for Emergencies

If something comes up in someone’s life, and they need money for an emergency, a payday loan is an easy way for that person to get the money quickly. Typically, the loans are approved fast, and the entire length of the loan is over with the person’s next payday. Thus, the name behind the loan.

3. Good for Big Purchases

If someone needs to buy something big for a holiday or if someone is moving out and they need a bit of extra cash, a payday loan can help. A person can apply, get the money, and pay it back with interest upon their next payday.

4. Adjustable Amounts

Unlike most loans, a payday loan usually offers the option of an adjustable amount. Meaning a person doesn’t have to max out the loan to get it. They can pick a lower amount or a higher amount on how much the loan offers and get approved either way.

Cons of Payday Loans:

1. High-Interest Rates

With a short term loan or any loan for that matter comes with interest rates. A payday loan usually has extremely high-interest rates because the law categorizes them as a cash advance. Some payday loans have an interest rate of over 400-percent. Because of this, people have to be very careful when they take out a payday loan.

2. Get Trapped Easily

Since they’re so easy to get, a person may get into a debt cycle. They will take loans out to pay off old loans driving them further into debt in a never-ending cycle.

3. The Loans Target Low-income Families

Payday loans specifically target low-income families. Targeting desperate people and charging them high-interest rates is a predatory practice. For many families, payday loans end up driving them further and further into poverty.

4. Payday Loans Don’t Help Your Credit

Although a lot of loans can help build someone’s credit score, a payday loan doesn’t build a person’s credit at all. Because of their ability to get approved for virtually anyone and their short-term lengths, payday loans can’t help a person’s credit score at all. Most of the time, they don’t even show up on a person’s credit history.

- Tulip Mania – The Story of One of History’s Worst Financial Bubbles - May 15, 2022

- The True Story of Rapunzel - February 22, 2022

- The Blue Fugates: A Kentucky Family Born with Blue Skin - August 17, 2021